By: The Nerd Collective

Cyclists riding e-bikes on a paved path through a park

Cyclists riding e-bikes on a paved path through a park

Leading voices from Workstand, Circana, and Bicycle Market Research provide expert perspectives on the electric bike market, analyzing current trends and future directions.

The Nerd Collective, a collaborative effort featuring Ryan Atkinson (President and Co-owner of Workstand), Matt Tucker (Director of Client Development at Circana), Peter Woolery (Managing Member of Bicycle Market Research), and Liam Donoghue (Bicycle Industry Senior Research Manager at PeopleForBikes), convenes monthly to deliver data-driven analyses of the bicycle industry’s most critical issues.

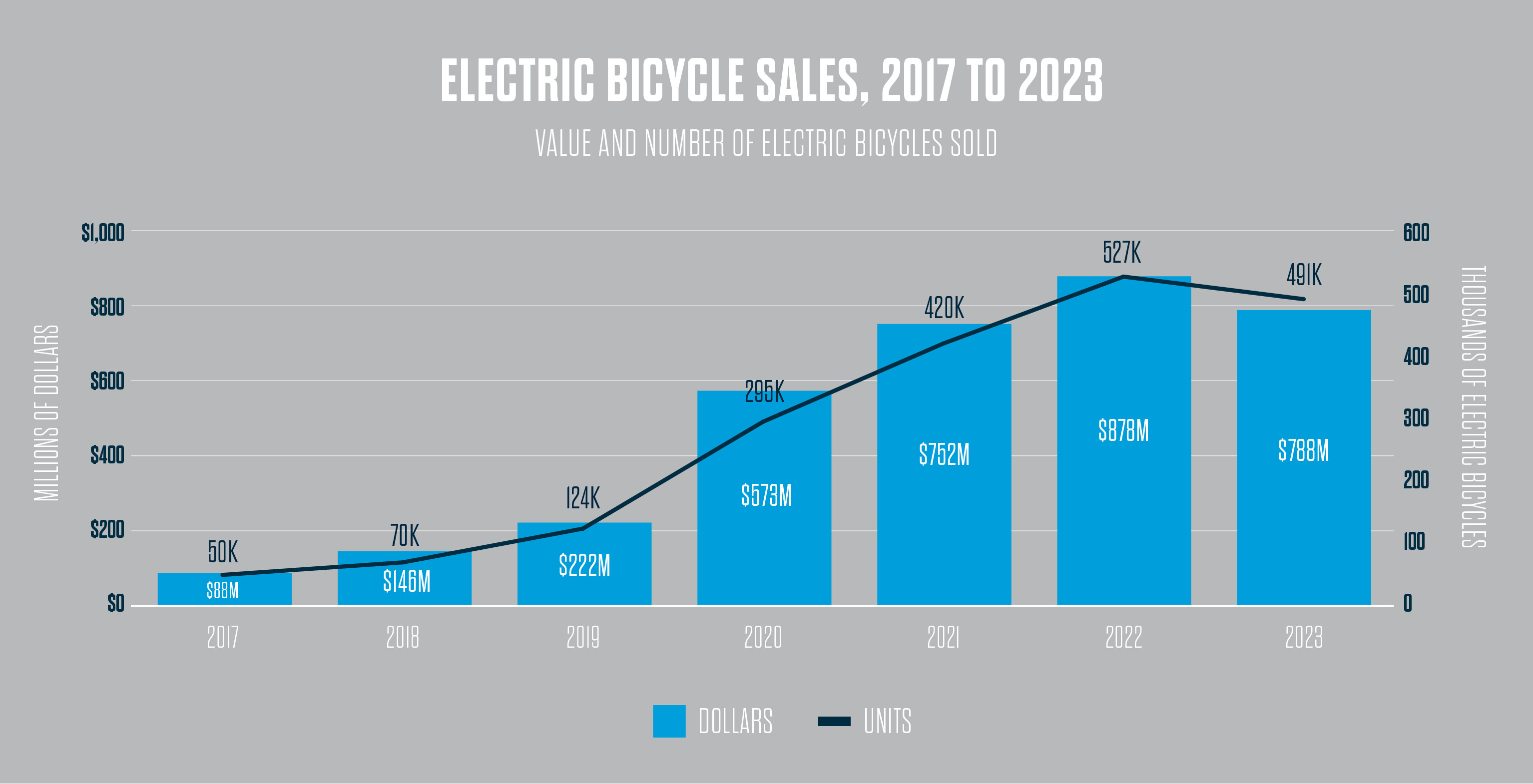

Electric bicycles have emerged as the primary catalyst for growth within the bicycle industry over the last half-decade. Data from Circana reveals that electric bikes accounted for an impressive 63% of the total dollar sales growth in the bicycle sector between 2019 and 2023. In 2023 alone, e-bikes represented 20% of the dollar sales and 4% of the unit sales across the entire tracked market.* Furthermore, e-bikes are the fastest-expanding category in independent bicycle dealer (IBD) e-commerce channels.** In this edition of the Nerd Collective blog series, our team of industry authorities addresses key questions surrounding the dynamic e-bike category.

ACCESS PEOPLEFORBIKES MEMBER-ONLY DATA INSIGHTS IN THE BUSINESS INTELLIGENCE HUB

Interested in becoming a PeopleForBikes member? Join the Coalition today.

Is the Electric Bike Sales Boom in the U.S. Showing Signs of Slowing?

Early in 2024, concerns arose about a potential deceleration in the rapid growth trajectory of Electric Bike Sales. However, with the availability of Q2 2024 data, the perceived dip in 2023 appears to be an anomaly, largely attributed to the pull-forward effect of sales from 2022. According to Circana’s data, electric bike unit sales have demonstrated robust growth year-to-date through April 2024, achieving a 13% increase compared to the same period in 2023.*

Chart showing year-over-year growth in e-bike unit sales through April 2024, indicating a 13% increase compared to 2023

Chart showing year-over-year growth in e-bike unit sales through April 2024, indicating a 13% increase compared to 2023

Sales data from Workstand’s IBD e-commerce platform further reinforces the sustained consumer demand for electric bikes. Online unit sales growth for e-bikes in April and May of 2024 exhibited a strong 60% increase relative to 2023. While slightly below the exceptional 69% growth observed between 2022 and 2023 for the same period, the current figures still point to a healthy market expansion.**

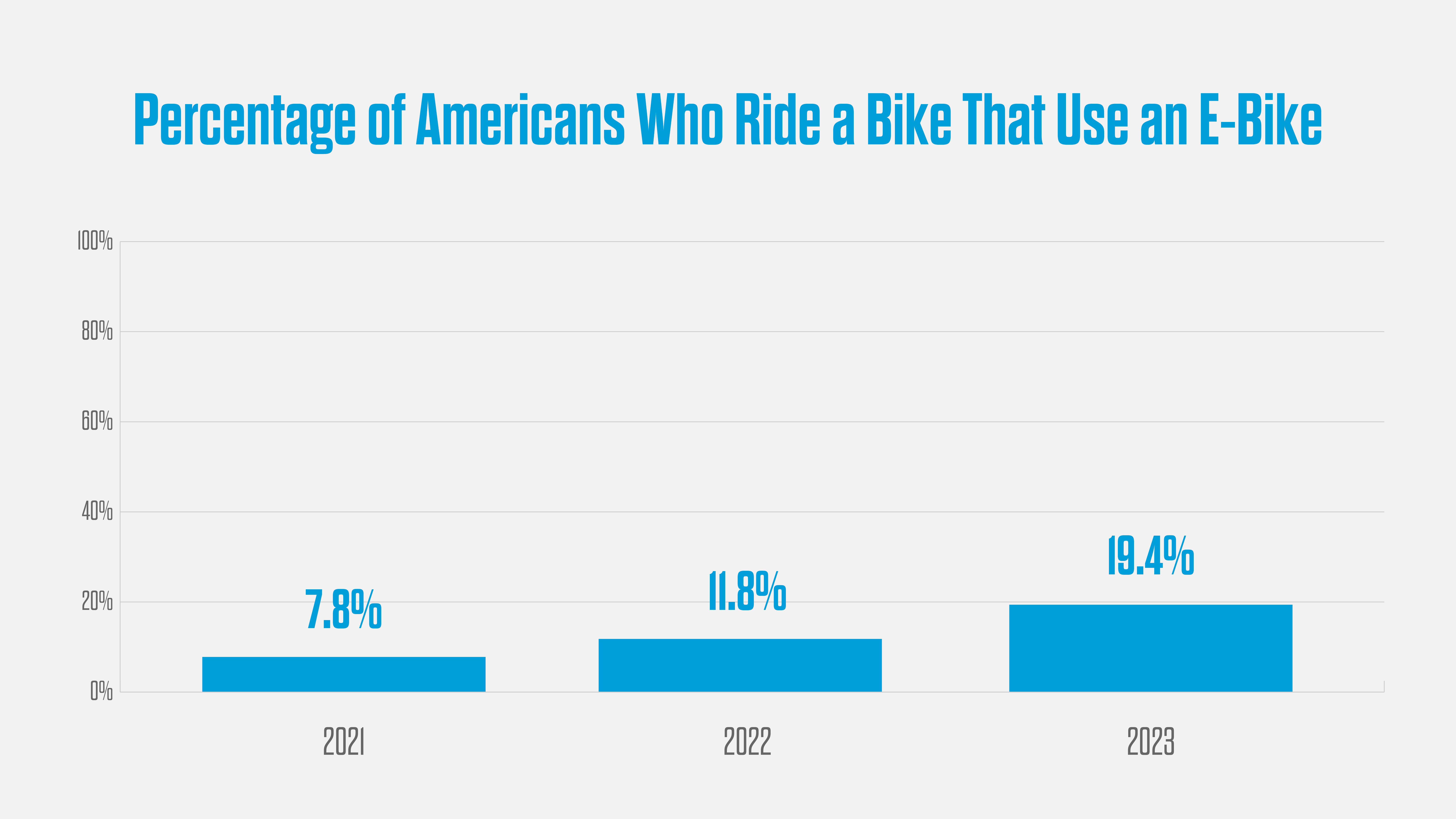

This upward trend is not confined to sales figures alone; interest in and adoption of e-bikes are also on the rise. A study conducted by the Physical Activity Council revealed that in 2023, 19.4% of Americans who had ridden a bicycle at least once reported using an e-bike, a significant jump from 7.8% in 2021. This comprehensive report is accessible to PeopleForBikes members within the Member Center and is also available for purchase through PeopleForBikes’ Resource Marketplace.

Bar chart illustrating the increasing percentage of American cyclists using e-bikes, rising from 7.8% in 2021 to 19.4% in 2023

Bar chart illustrating the increasing percentage of American cyclists using e-bikes, rising from 7.8% in 2021 to 19.4% in 2023

Are Average Selling Prices for Electric Bikes Experiencing a Decline?

Circana’s analysis indicates a notable price differentiation across sales channels. The average selling price (ASP) of an electric bike within the specialty channel (IBDs) stands at $3,055, significantly higher than the $669 ASP observed in rest-of-market (ROM) channels, which include big box retailers and sporting goods stores.* Furthermore, unit sales are expanding at a more rapid pace in ROM channels compared to IBD channels. This trend suggests that the adoption of e-bikes for casual riding is outpacing the growth in demand from enthusiast riders. Although ASPs have remained stable or slightly decreased in both segments (a 5% decline at IBDs and flat in ROM in 2023 compared to 2022*), potential tariff increases on imports from China could reverse this trend and drive ASPs upwards. The impending tariff increases on imports from China are a significant factor to watch in the electric bike market.

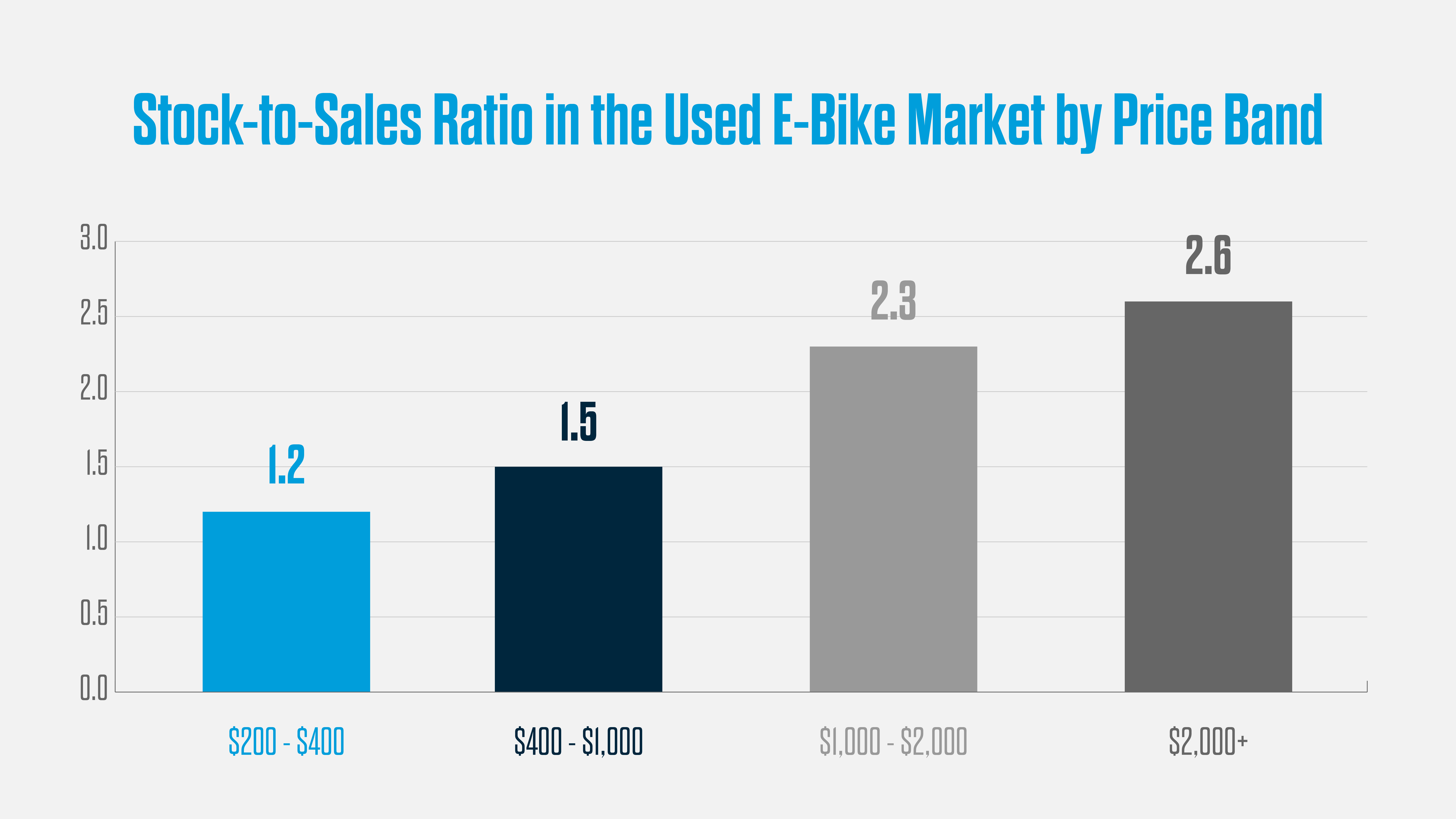

In the used bike market, strong demand is evident at lower price points, while mid-range and higher-end price points are not performing as strongly. As illustrated in the data below, the lowest stock-to-sale ratio in used e-bikes through May 2024 was in the $200 to $400 price range, with a ratio slightly above 1.0. This indicates that demand in this price segment nearly matched the volume of new used bike listings. Above $400, the stock-to-sale ratio progressively increases, reaching 2.3 in the $1,000 to $2,000 price range. Beyond this price point, the ratio stabilizes at approximately 2.6. This pattern implies that the ample availability and discounting of both retail and direct-to-consumer e-bikes are impacting demand for comparable bikes in the used market. Sellers willing to adjust their prices to align with typical mass market e-bike price levels are experiencing greater success in connecting with buyers.***

Chart showing stock-to-sale ratio for used e-bikes across different price ranges, highlighting stronger demand in lower price segments

Chart showing stock-to-sale ratio for used e-bikes across different price ranges, highlighting stronger demand in lower price segments

Access up-to-date used bicycle sales data in the PeopleForBikes Business Intelligence Hub.

Consumer Comfort with Online Electric Bike Purchases

Workstand data reveals that e-commerce sales growth for electric bikes is exceeding the overall IBD channel growth.** Although online sales constituted only about 2% of total e-bike sales by bike shops in Q1 2024, the substantial annual growth rate of 45% suggests a potential shift in consumer channel preference. Given that the vast majority of e-commerce electric bicycle sales tracked by Workstand are categorized as “click and collect,” bike shops are well-positioned to capitalize on this trend. By facilitating online sales with in-store pickup, they can capture a portion of the expanding online market while simultaneously driving foot traffic to their physical storefronts. The click and collect model offers consumers the convenience of online shopping combined with the assurance of local dealer support and service.

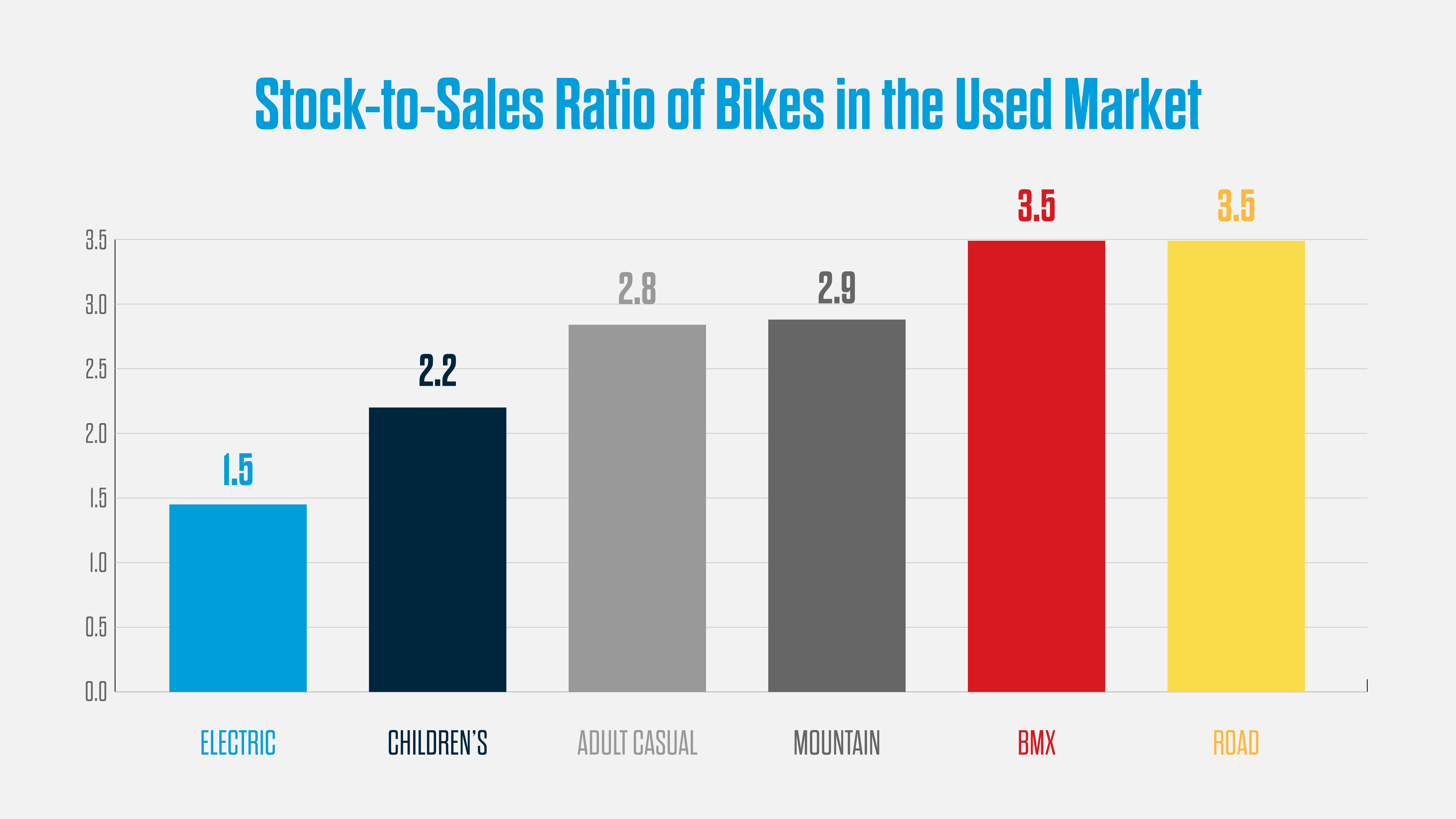

Consumers are not only increasingly comfortable purchasing new electric bikes online, but also used models. Bicycle Market Research data indicates that e-bikes have the lowest stock-to-sales ratio across all bicycle categories in the used market, demonstrating robust demand.*** Furthermore, the growth rate of used e-bike unit sales is outperforming that of traditional used bikes, indicating a strong and expanding market for pre-owned electric bicycles.

Chart comparing stock-to-sales ratio for e-bikes versus other bicycle categories, showing e-bikes have the lowest ratio indicating strong demand in used market

Chart comparing stock-to-sales ratio for e-bikes versus other bicycle categories, showing e-bikes have the lowest ratio indicating strong demand in used market

Do you have a question for the Nerd Collective to address in a future blog post? Submit your questions here.

*Data based on Circana/Retail Tracking Services, US Cycling POS Monthly

**Data based on Workstand IBD e-commerce sales data

***Data based on Bicycle Market Research data on peer-to-peer used marketplaces (eBay, Craigslist, Facebook Marketplace, Mercari)